Bank of Melbourne iPad Banking app for iPhone and iPad

Developer: St.George Bank Limited

First release : 17 Oct 2011

App size: 40.53 Mb

Bank of Melbourne Banking for iPad has been designed to give customers full banking functionality in an easy to use, intuitive environment.

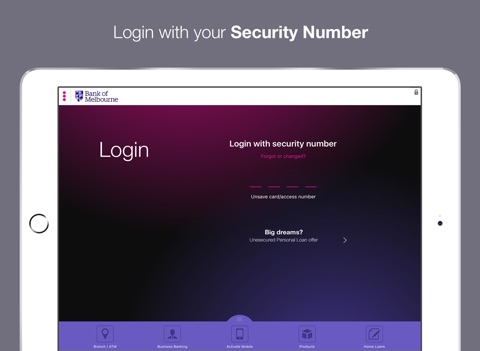

Fast login

• Use your Security Number to login

• Use your fingerprint to login on iPad Air 2, iPad mini 3 and iPad Pro (with iOS 8 and above).

Notifications and alerts

• Choose from 7 types of alerts: Low Balance, Withdrawal, Deposit, Dishonour, High Balance, Daily Balance and Credit Card Repayment Reminder

• Receive as a notification or email. Tap Services to set up.

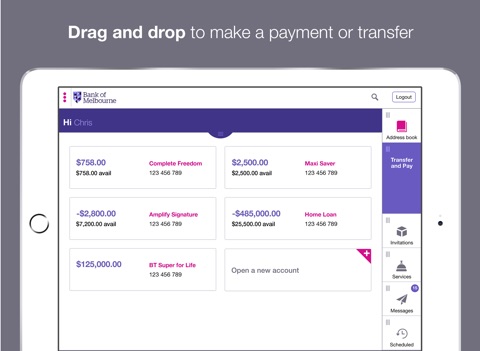

Payments & transfers

• Make transfers and payments (including BPAY)

• Pay someone using just their mobile number

• Quick Pay - save your favourite payments so you can pay them faster next time

• Overseas Transfers (Telegraphic Transfers) - send money overseas in your chosen currency to existing payees

• Schedule future and recurring transfers up to 24 months in advance.

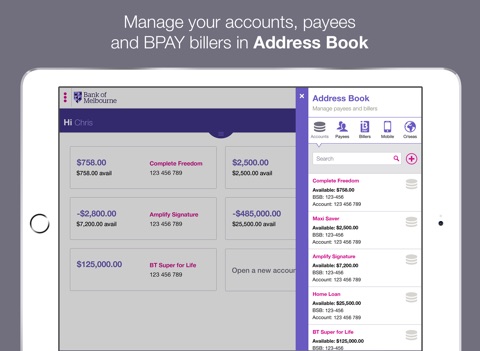

Manage your accounts

• View your account information, balances and transaction history

• Address Book – manage your payees and billers in one place, and see your past payments to each payee.

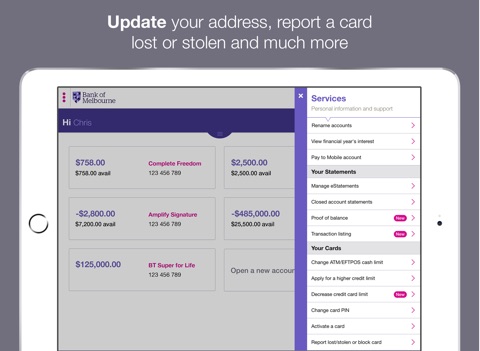

Tap the Services menu to:

• Set up notifications and email alerts. E.g. a Credit Card Repayment Reminder

• Switch to eStatements

• Download a Proof of Balance report

• Download a 30, 90 or 120 day transaction listing report

• Update your contact details

• Decrease your credit card limit^

• Dispute a credit card transaction

• Report your card lost or stolen

• Temporarily block transactions on your card for up to 14 days*

• Change your daily ATM/EFTPOS cash withdrawal limit for most credit and debit cards (daily limits apply)

• Tell us when you are going overseas

• Change your Security Number or password

• Activate your new credit or debit card

• View interest earned for the past 2 years

• Rename and sort your accounts

ATM & Branch Locator

• Locate your nearest Bank of Melbourne, BankSA or St.George ATM or branch in Australia

• Find a Global ATM Alliance ATM when overseas.

Need Help?

If you are having issues with our app, please delete and re-install it. If issues persist please call us on 1300 605 266.

Web: www.bankofmelbourne.com.au/online-services/tablet-banking

FAQs: www.bankofmelbourne.com.au/online-services/tablet-banking/tablet-banking-faqs

Facebook: www.facebook.com/bankofmelbourne

Twitter: www.twitter.com/bankofmelb

Things you should know:

^Cannot be decreased below the minimum limit. Available for all personal credit cards and Amplify Business credit cards, excluding joint owned cards.

*Blocking your card will temporarily stop new transactions on your card for up to 14 days or until reactivated. The card will reactivate after 14 days if you do not cancel the card.

Fingerprint login and other functions may not work on jailbroken devices.

Internet connection is required to use this app. Data charges apply.

Information is current at time of download and subject to change. We collect information on how you use this app for analysis of aggregate user behaviour.

You should read the Product Disclosure Statement or terms and conditions for the applicable product or service (including Tablet Banking) at bankofmelbourne.com.au before making a decision and consider whether the product or service is appropriate for you. Fees and charges apply on certain products and services.

Bank of Melbourne – A Division of Westpac Banking Corporation ABN 33 007 457 141 AFSL 233714 and Australian credit licence 233714.